Pandemic and recession: a double dip for New Silk Road

The current macroeconomic situation differs from a normal slowdown cycle, as it is reinforced by a virus crisis. It is not just an economic recession, but an economic crisis ánd a pandemic crisis. That will certainly result in a double dip, says Ekaterina Kozyreva of the Infrastructure Economics Centre.

In February, the UIC, a worldwide railway organisation, published a new report titled Eurasian Corridors, Development Potential. The Infrastructure Economics Centre (IEC), an independent think-tank based in Moscow and in Paris, contributed to this report. It provides an updated forecast of the Eurasian rail freight volumes up till 2030. According to Kozyreva, new reality follows not the baseline, but pessimistic scenario. The Russian analyst will share her thoughts at the RailFreight Summit Poland, to be held in Poznan on 1, 2 and 3 September. In this blog post, she provides a sneak preview.

First-of-its-kind crisis

The current situation in global economy is already described by various experts as a first-of-its-kind crisis, combining a long-awaited global economic fall with an unexpected fast deglobalisation caused by the COVID-19 pandemic, and intentional closure of borders.

In any case, it is already clear that the fast growth of Eurasian freight volumes that was observed in recent years will not continue in the nearest future, and many strategies of the market players will not come true. Still, in contrast to passenger transportation, rail freight is not suspended. Does this mean that all operations will resume later? Should market players wait or cancel all investment projects? Or are there new opportunities, arising from the crisis?

Macroeconomic context: a double dip

This crisis+crisis situation, or double dip, has got the following peculiarities:

- Supply drop instead of demand drop. Usual economic recession refers to the decrease of credit financing volumes, the fall in stock markets and the decline of demand. This time, due to artificial suspension of production and border closures, a shock in supply is observed. Supply chains are broken at different stages, and interruptions or suspensions on the earlier stages stop the following production. Demand drop will certainly follow, but this time it did not come first.

- New measures of support required. The supply drop cannot be overcome by usual anti-crisis measures of support from governments and national banks. And, as the situation is a unique one, no proved solutions exist. There is no tested recipe for governmental position on the additional support of infrastructure or transport operators for this case.

- Trade recovery delayed by geographical asynchronism. The asynchronous spread of COVID-19 followed by asynchronous and non-uniform actions of countries in terms of closure and opening will negatively impact on trade restoration. The case of China is an illustrative example: being reopened first, China faced undershipment of goods that were ready for export, but at the same time was limited by the suspension of production in the EU.

Further development of the economic situation depends on non-economic factors: the spread of COVID-2019, decisions of governments and other actors or the effectiveness of anti-crisis measures. All this causes a disparity in figures proposed by different experts, as well as decreases the average accuracy of the forecasts.

Rail freight business: a double take

It is quite evident that the consequences of crisis will drastically change the rail freight business. The volumes will drop down, if compared to all previous expectations, because many of these expectations were based on ‘baseline’ or even optimistic economic assumptions not considering deglobalisation. But, the peculiarity of this double crisis is that not only volumes or market shares will change. What will also change is the geography of transportation and the structure of market due to the disruption of supply chains and asynchronous actions. Is it still possible to find any opportunities for railways under these unfavorable conditions? The answer lies in between two crises.

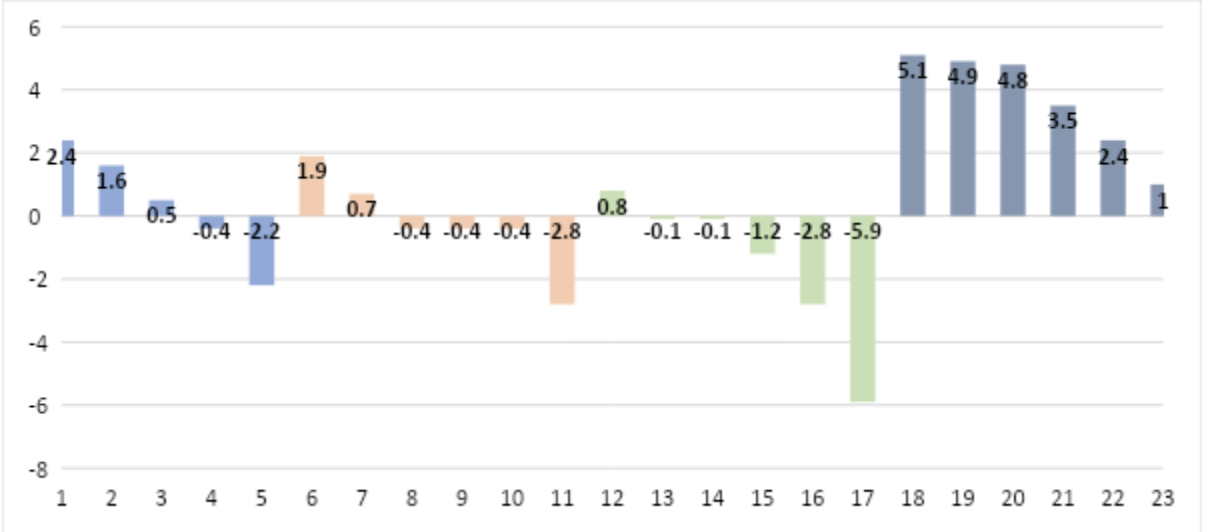

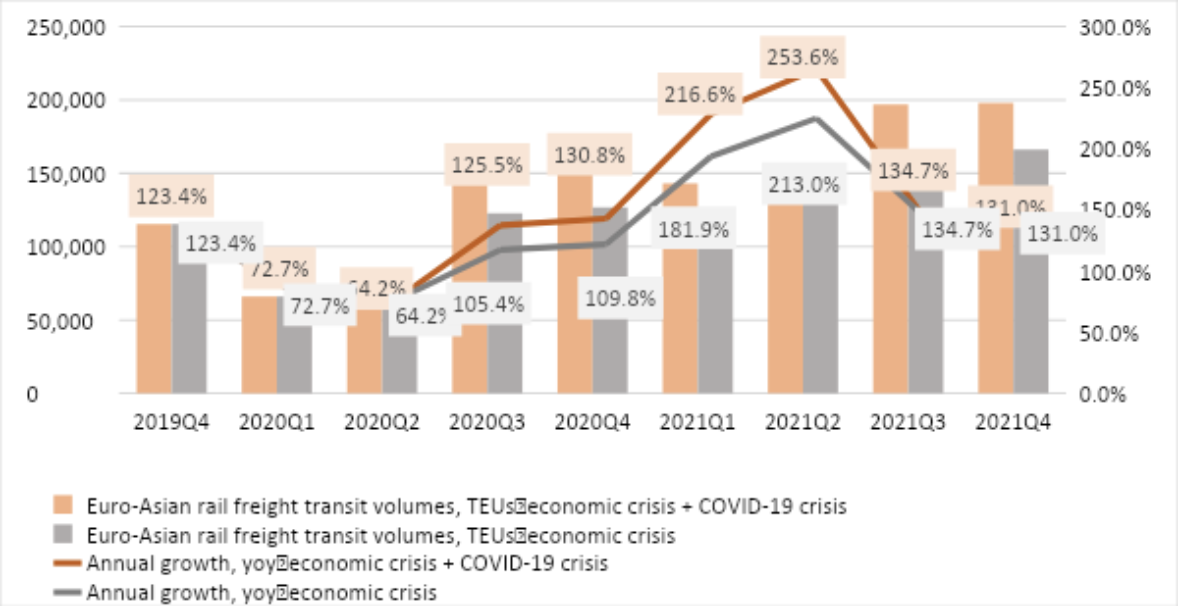

The graph represents the assumptions on further development of crises and Euro-Asian rail freight transit, it does not intend to forecast the exact timing of pandemic or the exact volumes. The idea is to compare a ‘usual’ economic crisis and the one caused by the pandemic. While the ‘usual’ one causes decrease of demand and results in decline of volumes and slowdown of growth, the COVID-19 crisis, which is spreading faster, results in undershipment of already produced goods.

This undershipment problem, the lack of supply which varies significantly for different commodities, should be solved as soon as possible after the reopening of production, and that defines the short-term opportunities for railways, which are obviously faster than sea and, as once again the Chinese example shows, less exposed to risks of transport restrictions than roads.

New supply chains

Of course, further development of economic crisis will most probably decrease the demand and the undershipment problem will quickly disappear. This is also true in case of a prolonged pandemic or significantly asynchronous trends of COVID-19 spread and recovery in Europe and Asia.

But in any case, what COVID-19 will leave us are the disruptions and even destroy of global supply chains. Railways have all chances to become a remedy for faster restoration of Euro-Asian links thanks to faster transportation, flexibility in volumes (also suitable for smaller amounts and parcels), coverage of long distances and lower prices in comparison to air.

Anti-crises vaccine for railways?

Economic turbulence is a time of fast decisions and limited investments, now combined with a lack of communication. So having a chance during a crisis is not equal to using it. To cope with recession and to use the chances to raise the general and the specific (for each market player) competitiveness of railways for international freight transportation, a ‘vaccine’ of most probably working solutions is necessary. What is mixed within the vaccine?

For market players, freight shippers and forwarders, railway operators and undertakings:

- high-quality marketing: determination of the exact types of commodities, niche, regenerating and new supply chains to focus on during the two crisis dips and definition of the exact demand of the producers;

- active cooperation and alliance building;

- precise investments in reliability of services;

- active development of digital solutions;

- focus on reliable door-to-door services in partnerships, also multimodal.

For the authorities, railway administrations and infrastructure managers:

- active communication, despite all inconveniences, and foster of joint initiatives and solutions, also to cope with possible underestimation of railways by customers;

- maximal preservation of existing partnerships and cooperation;

- preservation of minimal investments in rail infrastructure that can spur economic growth or smooth the slowdown;

- active development of digital solutions;

- focus on corridor approach, multimodality, interoperability and other solutions to assure end-to-end transportation;

- promotion of agreements on special legal regime to boost innovative processes and products in international transportation.

2021 Year of Rail

Although the global economic and non-economic disease certainly leads to a decrease of transit volumes in comparison to all previous plans, rail freight transportation gets a chance to increase its role in Eurasian links, and moreover, to contribute to their post-crises restoration. Both private market players, national authorities and rail administrations have got a prescribed mix of solutions to prepare for active marketing.

In the fourth quarter of 2019 the share of railways in transportation of containerised commodities along Eurasian routes was estimated at the level of 3.5 per cent, considering that the share of railways is usually higher by the end of each year than annual average. COVID-19 pandemic gives a chance to increase this share up to 5 per cent by the end of 2021 combined with a drop of overall trade volumes. The main challenge for railway market players will be retaining this share when trade restarts growing and despite possible changes in global supply chains. 2021 will be the European Year of Rail, and, if all rail stakeholders consider the arising opportunities, it can become a global one.

Written by Ekaterina Kozyreva, International Projects Director at the Infrastructure Economics Centre

Rail Freight Summit Poznan

Do you want to hear more about the New Silk Road forecasts? At the RailFreight Summit in Poznan, Ekatarina Kozyreva of the Infrastructure Economics Centre will elaborate on the predictions of the research firm. This event has been rescheduled due to the corona crisis and is now held on 1, 2 and 3 September. Registration is open.

Also read:

- UIC expects drastic impact of decline Chinese subsidies

- Chinese support policy also applicable to foreign companies

- Russia reduces empty container rate by up to 40%

- China-Europe trains see record figures despite corona crisis

- Is the revival of Eurasian rail freight short-lived?

- ‘East-West balance on New Silk Road can never be reached’

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer