China goes back to work, logistics still under lockdown

Most companies in China have returned to work yesterday, after an extended New Year holiday of weeks due to the coronavirus outbreak. Until now, this means little movement for the logistics industry. With a large part of the staff in quarantaine and nationwide road blocks to prevent the movement of people with an infection risk, the so-wanted made in China product is far from entering the supply chain.

“The current situation shows how much China depends on manpower”, says Jialu Zhang, working for the Dutch firm GVT Logistics. Other than in Europe, where warehouses are palletised and sometimes automated, in China the logistics industry is driven by people.”

And at the moment, only a small percentage of these people is available. When you are at risk of being infected, you are asked to stay at home. You are considered to be at risk when you have travelled to risk zones, or when you have been in touch with people from these areas. In the case of Hubei province, ground zero of the coronavirus outbreak, being born in a city of this province is enough to be considered a risk.

Trucks

This limitation is making logistics extremely complicated, even more so for the trucking companies, notes Marco Reichel, working from Crane Worldwide Logistics. “Truck drivers may not cross from one province to another. They may only drive within states.” For a shipment from Shanghai, where Reichel is based, this means that the possibilities are extremely limited. “A shipment from Shanghai is almost always transshipped in another province.”

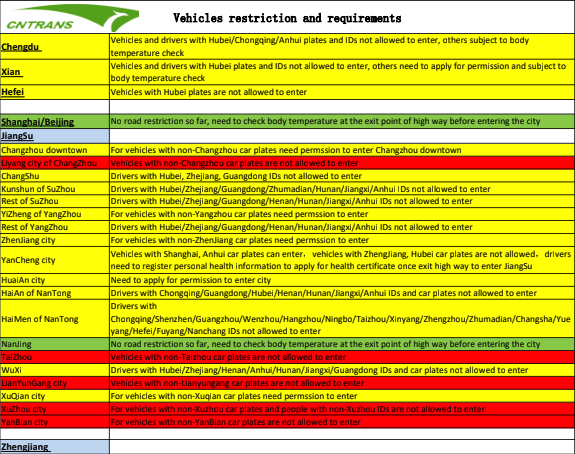

Jacky Yan from Chinatrans International adds to this that truck drivers are checked by number plate, ID, body temperature and permits. “These conditions are checked when entering certain cities. To make things more complicated, the rules are different for each city. Drivers from certain provinces or cars with plates from certain provinces are not allowed to exit the highway to enter certain cities without permission, or they are rejected to enter directly.” Yan has put all limitations in an information sheet, trying to update the industry realtime.

Train departures

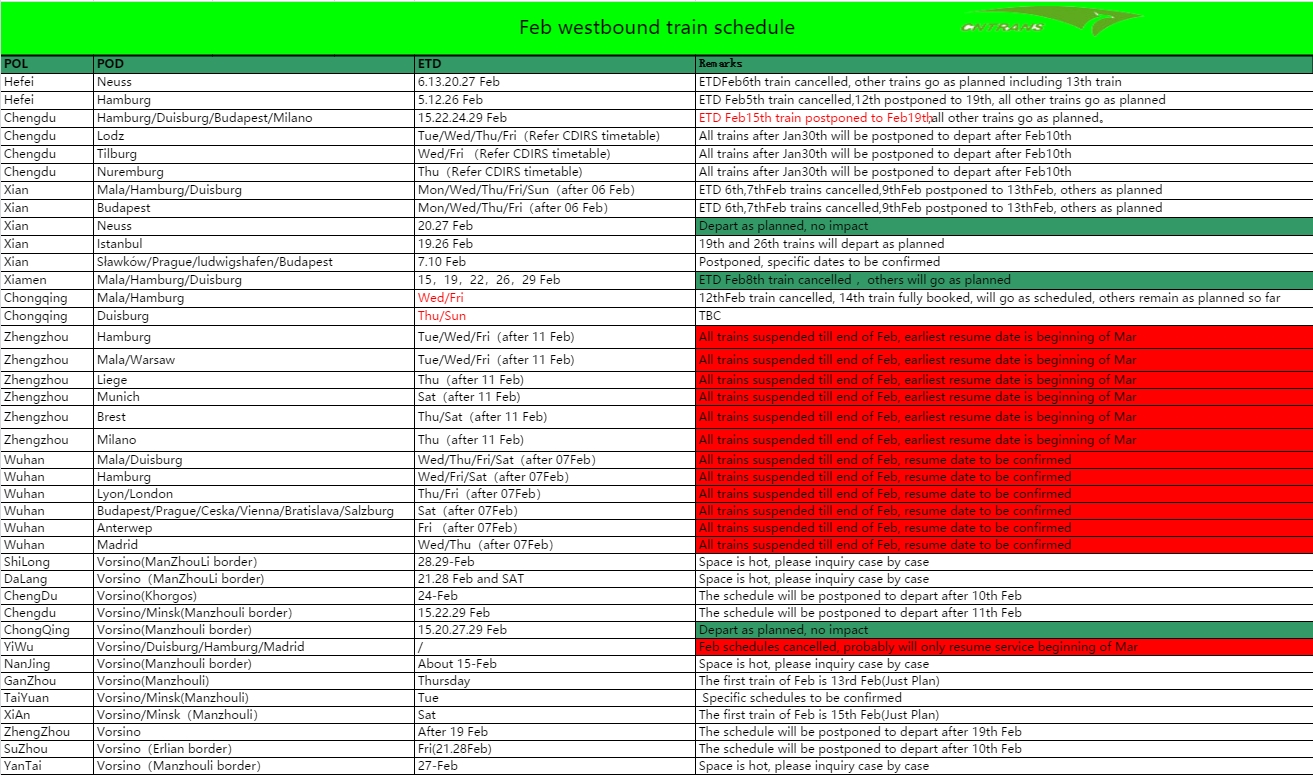

In the meantime, there have been some successful train departures, moving out cargo that had been stored in the terminals since the beginning of the Chinese New Year. Now that the holiday is, at least in most provinces, officially over, rail freight traffic is at the service of all those who do manage to bring the cargo onboard.

For example, a train departed Chengdu and is expected to arrive in Tilburg in about two weeks. “We are keen to see how this journey proceeds”, says Zhang, whose company handles the incoming cargo in Tilburg. “There are those who say the cargo may be scrutinised at the border with Poland. This may lead to a delay, and in result customers may be less eager to take the train.”

Rail as a solution

Yet, rail freight does seem to be the solution to the logistics lockdown. “Domestic rail freight is currently looked at to provide long distance haulage that is normally provided by trucks. The first mile is still a problem, but for the long distance, trains are currently a better option”, says Yan.

In general, rail freight seems to be affected the least among all modalities. Whereas air freight is witnessing massive price increases due to low availability of cargo space, and sea shipping lines are reported a major surge in blank sailings, a lot of freight is shifting to rail. If this is a trend to continue, the rail freight industry may see a hike in volumes once the supply chain is back in motion.

Restrictions

It surprises me that in a situation like this, the tight conditions for Eurasian rail freight remain in place. For example, freight trains must still be filled at a minimum rate of 90 per cent in order to depart. At the moment it would be useful if trains could also move with less cargo, as some of this cargo is urgent”, says Zhang.

On the same token, the decline of subsidies has continued as planned, a measure introduced to make Eurasian rail freight a more market driven industry. “Price increases in rail freight can be explained in this light, not as a direct consequence of the coronavirus outbreak”, she explains.

Webinar

These statements were made in the RailFreight Webinar of 11 February, in which we give an update on the current logistics situation in China. Participating in this webinar are Jialu Zhang, GVT Logistics (in studio), Jacky Yan, Chinatrans International (Chengdu) and Marco Reichel, Crane Worldwide Logistics (Shanghai).

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer

Nice article . It was really Worth to read and gather information in this pandemic related to working methods of logistics & Transport in different countries