‘East-West balance on New Silk Road can never be reached’

Traditionally, the volumes of rail freight going from east to west are higher than in the opposite direction. Industry players have worked hard to restore this balance with success. But, the balance will never be 50-50, warns the Infrastructure Economics Centre.

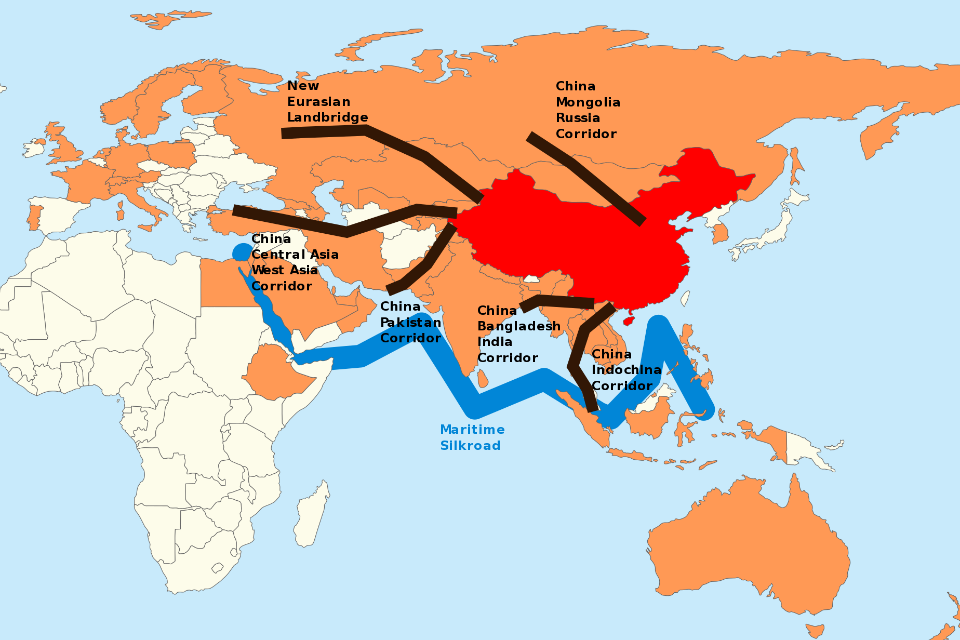

The IEC has carried out a study in which it measured the impact of macroeconomic factors on growth of Eurasian rail freight transport. Rather than analysing the rail freight market alone, they have looked at how the economy moves forward up till 2030. One of the conclusions they have drawn is that this east-west balance will never be as equal as the rail freight industry would like.

Never 50-50

In the year 2018, the allocation of Eurasian transit flows in westward direction represented 56,6 per cent of the total traffic (for loaded containers), while eastbound traffic represented 43,4 per cent. This is impressive. Whereas operators considered eastbound traffic a major challenge, it is filling most of its trains heading towards the east nowadays.

However, when looking at the forecast balance in 2030, the numbers do not change a lot. Rather, they show an even larger divide. According to the IEC report, the balance in 10 years from now is 57,9 per cent (westbound) and 42,1 per cent (eastbound). “This could even grow more out of balance due to the growing markets of Japan and South Korea, which have typical export markets too”, says Ekatarina Kozyreva, International Projects Director at IEC.

The imbalance is caused by a different structure of traded commodities. By 2030 the share of high-value added goods in China’s export is expected to continue growing in volumes, though less fast than before, whereas the European countries will increase the volumes of non-containerized goods in trade with China, Kozyreva explains.

Other factors

These predictions are based on the market mechanisms of trade, the so-called macro-economic factors. There are of course many other factors that could influence the Eurasian freight volumes, Kozyreva says. Such factors have also been pointed out in the study of the IEC. The reduction of Chinese subsidies is a major factor. But also infrastructure developments play a role.

IEC has carried out a survey among market players to evaluate these factors in in the mid-term period totalling 16 respondents representing key rail transit players in both Europe and Asia. The macro-economic factor got 8 votes, as much as cancellation of government support in certain countries , while the capacity limits of infrastructure got less: 6 votes. Political risks are also shown, but only play a minor role, according to respondent’s answers. All these answers were later tested in a mathematical model within a sowftware TMF®, owned by the IEC.

Combination

“What is important to understand from this, is that it is not a matter of economy or infrastructure alone. It is the combination of these factors, and more importantly, what comes first. If certain measures are taken at the right time, they can have the maximum benefit, while this could be different when done earlier, or later”, Kozyreva says.

To explain what she means, she takes the example of the upcoming markets Japan and South Korea. Whereas trade is now predominantly with China, the corridor is gearing up for much more transport to, and mostly from these Asian countries. The routings will be through Russia to the port of Vladivostok, where vessels connect with Japan or South Korea. The port infrastructure of Vladivostok must be enhanced if it wants to handle the growing volumes.

Perfect timing

“If there are more regular vessels from and to the port of Vladivostok without or before the acceleration of the Trans-Siberian railway to 7 days from Vladivostok to Krasnoe, the volumes could be increased by 36 thousand loaded TEU in 2030. However, if the same feeder lines are organised after the acceleration, the induced volumes would count more than 50 thousand TEU in Asia – Europe – Asia transit only (Asia – Asia volumes not calculated here).

The same counts for the lead time of the journey through Russia, which could be improved considerably with the raising of the speed of trains along the Trans-Siberian corridor. If this is done before the deacrease of Chinese subsidies to 20%-level, the induced volumes could reach 246 thousand loaded TEUs. However, if the same measures are carried out after the decrease of susbidies, the induced volumes will not even reach 107 thousand loaded TEU, even though the traffic related to the northern part of the Trans-Siberian route is not so much depending on subsidies in China like routes via Kazakhstan. However, it will already be too late, the traffic will go back to sea.

“The ambitions are to reach a million TEU on the New Silk Road. In 2018 we were handling 345 thousand loaded TEU. The targeted million could be reached, but this depends very much on the timing, and more precisely, order of the measures taken. If the conditions are favourable, but the solutions are badly timed or combined, the impact will not be as desired. One should also ask: do we first improve lead times, or improve port infrastructure? This priority setting is very important for growth on the New Silk Road.”

Balancing solutions

Does this mean that despite generally favorable macroeconomic conditions till 2030 for growth of transit, railways are anyway going to lose this battle for reaching up the balance? Certainly not, Kozyreva says. “There is no reachable balance for China – Europe – China trade, but the Europe – Russia or Europe – Kazakhstan trade structure is much more similar to China – Europe case. That means that transit trains complemented by export goods with interim stops at pre-defined larger logistics hubs on their way eastbound could be a solution to balance the situation and to assure better internal logistics for market players.

“This issue has been discussed within some transit countries, but still many constraints block the realisation: missing legal framework for combination of transit and export trains in Russia and Kazakhstan, a lack of related market products for customers (current vision of pay-for-speed could be diverted into two products: pay more for speed and pay less to let us balance the flows), a lack of balanced network of hubs in different countries that would allow best combination of transit and export flows, and a lack of implemented digital solutions to assure smooth combination.

“All these issues are to be jointly considered by market players and authorities. Together with the right order and timing of actions this assure the balance along the New Silk Road and the benefits for all parties.”

Rail Freight Summit Poznan

Do you want to hear more about the New Silk Road forecasts? At the RailFreight Summit in Poznan, Ekatarina Kozyreva of the Infrastructure Economics Centre will elaborate on the predictions of the research firm. This event has been rescheduled due to the corona crisis and is now held on 1, 2 and 3 September. Registration is open.

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer