Spain can do better with rail freight, says transport association

Spain is not utilising rail freight’s full potential. Despite sufficient infrastructure, the share of the goods transport market is still pretty low and could grow more. What factors hinder further expansion, and what solutions can the country implement?

The Spanish Transport Association (AET) conducted a study on the occasion of the European Year of Rail and concluded that Spain is lagging behind when it comes to exploiting its full rail freight potential. The study is titled ‘Cost reduction in the transport of goods by rail’ and argues that companies and authorities must cooperate and create a roadmap to promote rail freight in the Iberian logistic chain.

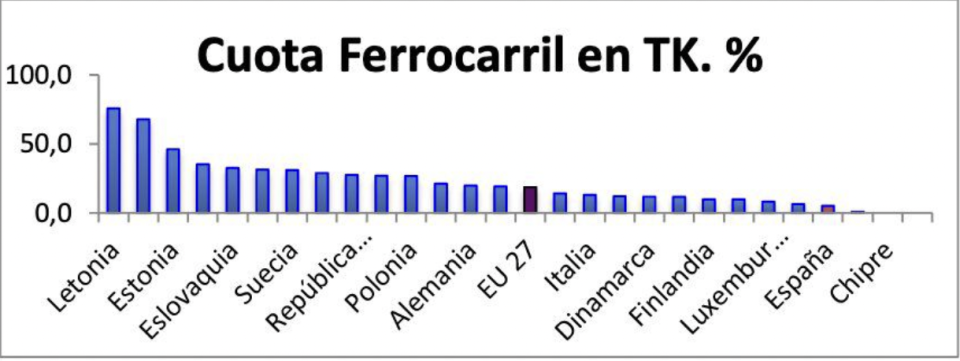

According to some findings, Spain occupies the penultimate position of European countries using rail freight. When it comes to volumes transported by rail, Spain has only five per cent of tons per kilometre on trains. Numbers from 2019 are indicative of the situation. Specifically, from the 87 million tonnes of Spain’s international traffic in 2019, only 4,5 were transported by rail.

Problematic points

AET identified some trends in the Spanish transport market that pose problems to the growth of rail freight. For example, there is no level playing field between road and rail transport regarding the pricing offers and the external costs paid. If the situation persists, there is no point in presenting rail as the most sustainable transport mode without creating the right growth conditions. Additionally, the government has paid more attention to developing high-speed lines and prioritised passenger over freight transport in the past years. This will need to change and focus on both sectors equally.

Moreover, promoting intermodality is also a field where Spain is not competitive at all. “The absence of a multi-client intermodal offer that will facilitate road transport companies to have easy rail access is one of the main causes that Spanish rail freight is underdeveloped,” underlined AET. Finally, the political dependence on the public sector also slows things down notably.

‘Co-modality’ as a solution

“The government needs to reduce the costs of rail freight immediately,” stresses AET. An interesting proposal by the association asks for the creation of a Co-modality/Intermodality unit within the Spanish transport ministry. The unit will work exclusively on promoting intermodal transport solutions, creating incentives for companies to shift from road to rail and accelerating the building of railway motorways for multi-client services.

Complementary to this solution, AET proposed that ADIF should also move in the same direction. Specifically, it requested that the state-owned infrastructure company should provide sufficient funds to improve Spain’s intermodal infrastructure. The focus should turn to intermodal terminals, border terminals, minimum gauge for P-400 semi-trailers and incompatible tracks for freight trains. On top of that, the maximum weight per axle should be increased to allow heavier trains to run on tracks. Currently, the regulation allows 22,5 tons per axle.

In conclusion, AET asks for something that could be self-evident according to the EU regulations. It urges Spain to take advantage of the European green rules that promote sustainability and enable rail freight to become the country’s flagship in the green transition. As we move towards the end of the European Year of Rail and as the European Union has clarified rail’s role for green mobility, taking the needed measures could help Spain transform the Iberian peninsula into the “logistics platform of Europe”.

Also read:

- Spanish fruits and vegetables on the train to London

- Spain works on master plan to enable 750-metre trains to east coast

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer

There is also a lot of opposition to intermodal solutions from the road transport industry who want to preserve jobs even if they are highly polluting jobs. There is huge volume from Spain to Northern Europe and Scandinavia that should be viable if the right railfreight solution is in place. But local road haulage industry interests are the main challenge here.