Rail freight critical to North of England economy says new report

A new report for Transport for the North reveals that the regional freight and logistics sector could be worth more than thirty billion pounds to the national economy. Rail freight has been identified as critical to the overall development of the region. By 2050 it could be worth more than thirty billion pounds (36bn euro) to the North’s economy and employ more than 500,000 people. However there are investment opportunities being missed, which may well undermine adoption of rail freight as a preferred mode.

TfN, the subnational body with responsibility for promoting improved transport infrastructure across the region, has been showcasing the importance of the sector as a facilitator for economic growth. Unsurprisingly, a key element of the report is a desire to decarbonise freight, primarily through modal shift to rail based logistics. The strategy for the North of England, published by Transport for the North, looks at all aspects of the industry and concludes that the region’s road, rail and inland waterway networks must all be used more harmoniously, despite investment shortcomings in the latter two modes.

Current and future requirements need investment

The Freight Logistics Strategy report looks at the broad picture for the North. Rail freight capacity developments at ports on both sides of Great Britain play into the hands of the new report. According to TfN analysis, more than a third of goods enter Great Britain through Northern ports, such as Liverpool, Hull and Sunderland. A quarter of all British moved freight starts or ends its journey in the North. By 2050 those goods could be worth more than thirty billion pounds to the North’s economy and employ more than 500,000 people.

“It is the first pan-Northern freight and logistics strategy of this type and complements our Strategic Transport Plan in developing a multimodal freight strategy for the North of England”, says TfN. “To see growth in the sector that meets the current and future requirements of our region and the UK economy, investment is required.[These are] to address three main areas of constraint across the road, rail and inland waterway networks: network capacity and capability, terminal availability and decarbonisation.”

Reduce the carbon impacts of freight and logistics

“Our Freight and Logistics Strategy, which covers road, rail and waterway freight, reveals the data that drives the sector and identifies the opportunities for decarbonising the sector”, said Martin Tugwell, the chief executive at Transport for the North. “The drive to reduce the carbon impacts of freight and logistics runs through this strategy. We have a clear vision and want to see continued growth in the sector that will help unlock the economic potential of the North. Our approach puts the needs of the user at the heart of our work for only in this way will our solutions deliver real results for businesses and communities.”

Uncertainty over the future of rail investment is still an issue for the region. Despite repeated announcements from the government in London, the ‘stop-go-redefined’ nature headline projects, such as Northern Powerhouse Rail, leaves business decision makers seeking flexible, rather than fixed solutions to their forecasted logistics requirements. These are issues the report seeks to address, but the major stumbling block of funding control remains unresolved.

Deliver sufficient capacity for enhanced freight

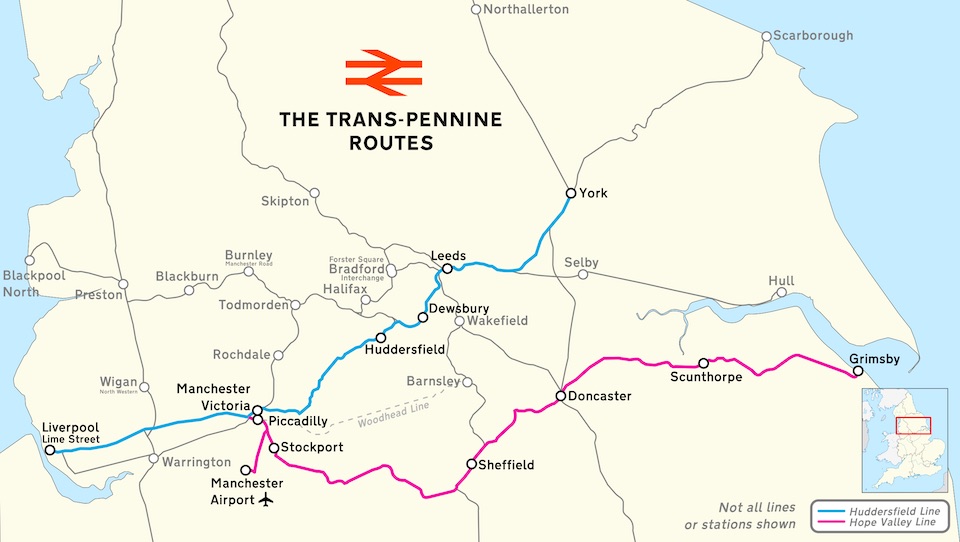

While development of the rail network is welcomed in the report, the abandonment of the optimal ‘Northern Powerhouse Rail’ programme is not ignored. The much vaunted Transpennine Route Upgrade has been questioned over its ability to deliver sufficient capacity for enhanced freight operations, as well as an intensified passenger timetable, and other routes, particularly a connection between Manchester and Leeds (the Diggle Route) remain lacking in significant investment.

“Northern Powerhouse Rail and other initiatives supported by TfN seek for more of the rail network in the North to be electrified”, says the report. “Network Rail has issued an interim programme business case for its Traction Decarbonisation Network Strategy. However, there is no certainty of funding for electrification of the wider network – and the routes used most by freight traffic (excepting sections of the Midland Main Line) tend to be lower priorities than routes used by frequent passenger services. Network capacity issues may also drive freight onto alternative routes to the West and East Coast main lines that currently have a still less pressing case for electrification investment.”

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer

Simply for utilisation of assets – and of Advantage… capacity shall not remain bottleneck!

All other modes upgrade, for added load capacity – and for lower costs, etc…

Short, heavy trains, is better, than long – and the single sustainable…

Per train, safely added load – and speed, will add capacity…

(Current standard, high quality steel rail section, safely allows for 45 ton axial load – when, not as currently hampered by an old track standard, etc., etc.)